straight life policy term

It is also known as whole life insurance. 1 hour agoWith a term life policy its possible to pay for coverage only during the 10 to 30 years or so when its actually necessary.

What you need to know is that in todays terminology straight life insurance is the same as whole life insurance.

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

. A straight life insurance policy provides coverage for a lifetime with constant premiums throughout the policys term. A straight life policy has what type of premium. Straight Term Insurance Policy.

At one time the cash value exceeded 100000 and was worth 150000. Put You and Your Loved Ones on a Path Toward Financial Preparedness for the Future. Straight life insurance policies.

Policygenius Works with Americas Top Life Insurers to Help You Get Life Insurance Right. Whole life insurance is a type of life insurance that provides coverage for the entirety of the policyholders life and has a savings component. A decreasing annual premium for the life of the insured.

Straight refers to the premium structure of the whole life insurance policy. Limited pay whole life D. What is a Straight Life Policy.

Ad Rates starting at 11 a month. After all a straight life insurance policy is much. Ad Life Insurance Provides Peace Of Mind Knowing Youre Protecting People You Love.

Calculate the reduced paid-up insurance for Lee Chin age 42 who purchased a 230000 straight life policy. Connect with a New York Life Agent. The term straight life insurance is no longer used in the insurance industry but it pops up occasionally when people talk about life insurance.

Use Table 202 Reduced paid-up insurance Years Insurance policy in force 9 5 10 15 STRAIGHT LIFE 20-PAYMENT LIFE 20-YEAR ENDOWMENT EXTENDED EXTENDED EXTENDED Amount of TERM Amount of. Like other forms of whole life insurance the death benefit of a straight life policy is guaranteed to remain in place for life if premiums are paid. Decreasing term insurance is a type of annual renewable term life insurance that provides a death benefit that decreases at a predetermined rate over the life of the policy.

Ad Find the Right Life Insurance Policy for Your Needs. A straight life insurance policy is a type of permanent insurance that provides a guaranteed death benefit and has fixed premiums. If friends or family members have advised you to look into straight life you will.

This terminology denotes that premiums for the plan will be level meaning they will not increase or decrease during the life of the policy. Ordinary life policy C. An insured has a variable life policy with a 100000 face amount.

This guide will discuss what straight life insurance is and how it works. This traditional life insurance is sometimes also known as whole life insurance or cash value insurance. Straight life insurance is a type of policy that pays out a benefit to the policyholder upon their death.

A straight life insurance policy offers coverage that lasts a lifetime with premiums that stay the same over the life of the policy. Sets with similar terms. Straight Life Policy an ordinary life policy or whole life policy.

With a straight life policy a portion of your premium pays for the insurance and the rest accumulates tax deferred in a cash value account. As with all whole life insurance contracts at age 100 the policy cash value. Straight Whole Life Insurance Provides Permanent Level Protection Level Premiums and Cash Value Accumulation For the Life of the Policy.

It contrasts with term life insurance which only. A life insurance policy that provides coverage only for a certain period of time. A straight life annuity sometimes called a straight life policy is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or a.

Compare Plans to Fit Your Budget. Premiums are usually. Straight Whole Life Insuranceor ordinary life provides permanent level protection with level premiums from the time the policy is issued until the insureds death.

Straight life insurance is a type of whole life insurance. While straight life insurance offers lifelong coverage term life insurance provides temporary life insurance coverage. Premium payments are level.

Help protect your loved ones with valuable term coverage up to 150000. Ad Get a Free Quote Now from USAs 1 Term Life Sales Agency. Upon expiration the policyholder may decide to renew the policy or allow it to lapse.

See your rate and apply now. Term to specified age B. A straight term insurance policy provides a benefit upon the death of the policyholder but ceases to provide this benefit if heshe is still alive when the policy expires.

Life Paid-up at Age 65. Like all annuities a straight life annuity provides a guaranteed income stream until the death of the annuity owner. Ad Shop Term Life Policies from Top Companies in One Place to Find Your Lowest Rate.

Prudential Has The Life Insurance Options To Fit Your Needs. They wont go up regardless of age or health. Continuously premium straight life policies are designed so that the premiums for coverage will be completely paid for by the insureds age of 100.

For example you could have a 100000 straight life insurance policy for which you pay 30 a month. Life Paid-up at Age 65 D. At the end of year 15 Lee stopped paying premiums.

A straight life insurance policy offers coverage that lasts a lifetime with premiums that stay the same over the life of the policy. A straight life annuity sometimes called a straight life policy is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or a death benefit. Renewable Term to Age 70.

Which of the following is an example of limited pay life policy A Level Term Life B. It pays out a death benefit upon the policyholders death and it accumulates cash value over time that the policyholder may withdraw for personal use or borrow against. Life Insurance Policies QA.

This type of policy can be used as an estate planning tool or to provide financial security for loved ones. This terminology denotes that premiums for the plan will be level meaning they will not. If you are looking for an insurance product that will provide some long-term planning a straight life policy is made to last a lifetime so it might be a policy to look into.

Straight life policies are not designed for short-term needs as it often takes years to see any income returns from the policys cash side. However straight life insurance is significantly more expensive than term life.

/GettyImages-1134608493-a72c93c4adc34ee3b5a1c6e54dffa379.jpg)

Whole Life Insurance Definition

How Does Life Insurance Work The Process Overview

Understanding Section 7702 Plans Bankrate

Pin On Personal Finance Money Tips

Lcx Life A Life Insurance Settlement Company Life Life Insurance Health Challenge

When Can You Cash Out An Annuity Getting Money From An Annuity

How To Choose The Right Life Insurance Policy In 2022 Life Insurance Policy Permanent Life Insurance Life Insurance Types

When Can You Cash Out An Annuity Getting Money From An Annuity

Annuity Payout Options Immediate Vs Deferred Annuities

What Is Whole Life Insurance And How Does It Work Lincoln Heritage

Understanding Section 7702 Plans Bankrate

Whole Life Insurance Definition

Comparing Term Life Vs Whole Life Insurance Forbes Advisor

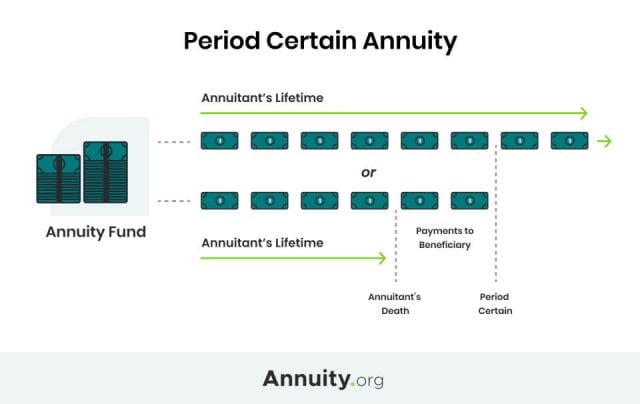

Period Certain Annuity What It Is Benefits And Drawbacks

Joint And Survivor Annuity The Benefits And Disadvantages

/GettyImages-184985261-257061c6b35546779a16b51ca1e9da8e.jpg)